#apply for vat registration uk

Explore tagged Tumblr posts

Text

VAT Services in the UK: Understanding the Basics and Benefits

Value Added Tax (VAT) is a crucial aspect of the UK's tax system and is a consumption tax placed on the value added to goods and services. It is levied on most goods and services sold by businesses in the UK, as well as on imports. Businesses need to comply with VAT regulations to avoid penalties and ensure proper financial management. This article will explore VAT services in the UK, including registration, compliance, filing returns, and the Economic Substance Regulations (ESR) impact on tax systems.

What Is VAT?

VAT is a tax charged on the sale of goods and services, typically at a standard rate of 20%, though some products may qualify for reduced or zero rates. Every business that exceeds the VAT registration threshold, which is currently £85,000 in annual turnover, must register for VAT with HM Revenue & Customs (HMRC).

Once registered, a business must charge VAT on its goods or services, file VAT returns with HMRC, and pay any VAT collected from customers to the government. VAT-registered businesses can also reclaim the VAT they pay on purchases related to their business activities, which helps avoid double taxation.

VAT Registration Process

The VAT registration process in the UK is straightforward. Businesses can register online through HMRC’s website. When registering, they need to provide their business details, financial records, and estimated annual turnover. Upon successful registration, the business receives a VAT number that must be included on all invoices.

For businesses operating below the threshold, voluntary registration is also possible. This can be beneficial as it allows businesses to reclaim VAT on purchases, which can improve cash flow and reduce costs, especially if they deal with VAT-registered clients or suppliers.

Compliance and Filing VAT Returns

Once registered, businesses must maintain accurate financial records of all VAT-related transactions. This is essential for calculating the VAT they owe or can reclaim from HMRC. VAT returns typically need to be filed quarterly, although some businesses may file monthly or annually depending on their agreement with HMRC. Filing is done digitally, in line with HMRC’s “Making Tax Digital” (MTD) initiative, which aims to streamline the tax system and reduce errors.

Non-compliance or incorrect filings can result in fines or penalties, so businesses often rely on professional VAT services to ensure compliance. Accountants or VAT specialists can help navigate the complexities of VAT law, especially for businesses dealing with cross-border transactions or in industries with specific VAT rules.

Economic Substance Regulations (ESR)

The Economic Substance Regulations (ESR), while primarily relevant to offshore jurisdictions, have also had implications for UK businesses, especially those engaged in international trade or holding companies in offshore financial centres. ESR ensures that companies claiming tax benefits in certain jurisdictions must have substantial economic activities within those regions. This means that businesses cannot simply shift profits to low-tax regions without having real economic presence or operations there.

Although ESR does not directly apply to UK domestic businesses, it has raised awareness about economic substance globally, encouraging businesses to ensure their activities align with their tax filings. UK businesses involved in international dealings should be mindful of these regulations, as they can affect cross-border transactions, holding structures, and tax planning strategies.

The Benefits of VAT Services

Professional VAT services offer numerous advantages, especially for small and medium-sized enterprises (SMEs) or businesses engaged in international trade. Some of the benefits include:

Ensuring VAT compliance and avoiding penalties.

Optimizing VAT recovery on business expenses.

Managing cross-border VAT obligations.

Staying updated with changes in VAT law.

In conclusion, VAT services in the UK play a vital role in helping businesses navigate the complexities of tax compliance. With the added influence of global measures such as the Economic Substance Regulations (ESR), businesses are encouraged to ensure that their operations are not only compliant but also transparent and aligned with international standards. Whether a small business or a multinational corporation, understanding and managing VAT obligations is essential for financial success and growth.

Our website is the perfect resource for further details.

Personal Income Tax Services in UK

IFRS/Corporate tax/VAT Trainings UAE

0 notes

Text

Cross-border VAT audits: Preparing for increased scrutiny

The face of VAT compliance has changed in the recent past. Globalisation and increasing complexity in the supply chain make cross-border VAT audits formal. This would mean businesses having to find their way through a web of regulations and ensuring that their VAT practices measure up to the mark. This blog shows how businesses can prepare for such heightened scrutiny involved with cross-border VAT audits.

What are cross-border VAT audits?

VAT cross-border audits aim at scrutiny of the records of value-added tax and compliance of transactions spanning across many countries. The audits are carried out by tax authorities to ensure that businesses apply the rules and regulations of VAT correctly across various jurisdictions. With the increased wave of international trade, tax authorities are increasingly putting their focus on cross-border transactions in order to avoid fraud and also ensure the correct collection of VAT.

UK VAT Registration

IOSS VAT Registration

Why are cross-border VAT audits becoming more common?

The following are some of the major drivers of the increase in cross-border VAT audits:

Globalization and Trade Expansion: The more businesses run across borders, the more complicated VAT compliance becomes. It gives authorities a keen eye to make sure VAT obligations are met in each jurisdiction.

Technological Advancements: Sophisticated data analytics and electronic invoicing systems will facilitate the tracing and analysis of transactions by tax authorities.

Need for More Revenues: Governments face budgetary pressures and therefore attach considerable importance to VAT compliance as a source of revenue generation. This has made auditing practices more proactive.

According to the European Commission, in 2022, the estimated VAT revenues lost due to fraud and non-compliance reached EUR 93 billion only for the EU; this shows its growing importance.

How can businesses prepare for Cross-Border VAT audits?

It’s not possible to sail through cross-border VAT audits without proper preparation. Some of the steps that a business must take are as follows:

Understand the VAT regulations in each jurisdiction

Countries have varying rules and regulations with respect to Value-Added Tax. It is important that businesses are aware of such value-added tax requirements in any country a business entity is involved in. This would include:

VAT Rates: Many countries apply different rates of VAT on different types of goods and services.

Exemption Rules: The rules governing VAT exemption and zero-rated supplies may be different in every jurisdiction.

Documentation Requirements: Proper documentation is essential for compliance and supporting VAT claims.

Staying up-to-date on changes to the VAT regime is very relevant. For instance, as a result of the OECD’s BEPS project, new guidance has been issued which may impact cross-border VAT practices.

Maintain accurate and comprehensive records

Proper record keeping is the most crucial factor for ensuring VAT compliance. Check that your record-keeping is full and up-to-date, including:

Invoices: Keep all invoices issued and received, ensuring that they are in line with the VAT requirements placed on you in all jurisdictions.

Contract: Document all the terms of the cross-border deals, including payment methods and value-added tax treatment.

Customs Declarations: Retain records of any information which serves as proof for the customs declaration of goods that cross the border.

The International VAT Association reported that the risk of penalties arising from an audit can be significantly reduced if a robust record-keeping system has been maintained.

Implement robust internal controls

Internal controls also aid compliance with the VAT regime and minimise errors to the best extent possible. The following controls may be considered:

Automated Systems: Make use of VAT compliance software for the automation of calculations and generating accurate reports.

Regular Audits: Conduct internal audits for reviewing the VAT process and to point out the problems, if any, before external auditors do.

Training: Undertake regular staff training in respect of the VAT regime and compliance procedures.

A study by the VAT Forum indicates that the use of automated VAT compliance tools can reduce errors and enhance efficiency.

Conduct a Self-Assessment

In case of self-assessment, you would have to relook at the VAT practices for improvement opportunities. Top such attitude and approach can assist proactively:

Identify Risks: Spot potential compliance issues before they become problems.

Procedures Updating: This will involve reviewing the VAT procedures in line with the new regulations and best practices.

Prepare for external audits: Many of the concerns raised during the self-assessment phase shall have to be worked on to make the process of external audit more streamlined.

Engage with VAT experts

VAT experts can bring on board valuable insight into ensuring compliance. VAT consultants can:

Interpretation of Complex Rules: The firm will assist you in understanding the complex rules of VAT and their application in different countries.

Assistance with Documentation: Ensure that your document meets up to the requirements of each country.

Provide Audit Support: Offer guidance and support in case of VAT audits to handle all issues related to the same.

According to Deloitte, businesses that used VAT consulting services surveyed reported, at worst, as low as 20% in audit findings and penalties.

What are the consequences of non-compliance?

Failure to comply with cross-border VAT regulations runs the risk of incurring very serious penalties, including:

Fines and penalties: Non-compliance can result in several fines and penalties, which could have financial implications for your business.

Reputation damage: Bad VAT practices can ruin your image and lose the trust of your customers and/or partners.

Enhanced Scrutiny: Non-compliance may mean that your business is subject to higher frequency and depth of the audit, thus burdening the business more.

According to the European Commission, failure to comply with VAT obligations may lead to financial losses and operational problems for companies in the VAT Gap Report.

Any business requiring cross-border VAT compliance support can avail expertise from Cross-Border VAT on audit support. You can also seek help when expanding your operations to the EU and UK.

In summary, successful preparation for cross-border VAT audits requires familiarity with the rules on value-added tax, keeping of records, internal controls, and support. Businesses with such measures in place can be sure to stay on top of the intricacies of cross-border VAT compliance, reducing thereby the potential risks related to close scrutiny.

Disclaimer:

This blog is for information purposes only and should not be relied or acted upon when making financial decisions. Always seek professional advise prior to taking any action.

0 notes

Text

UK Home Furnishings Business: How Foreigners Can Start

Introduction

Establishing a home furnishings company in the UK as a foreigner can seem challenging at first, but it can be a profitable business with the correct strategy and in-depth knowledge of the market. The UK's home furnishings market is vibrant and diverse, offering ample opportunities for entrepreneurs to succeed. Furniture manufacturing is one of the top 03 divisions driving manufacturing growth in the UK.

The UK Home Furniture Market size is estimated at USD 18.78 billion in 2024 and is expected to reach USD 21.98 billion by 2029, growing at a CAGR of 3.20% during the forecast period as per https://www.mordorintelligence.com/industry-reports/uk-home-furniture-market

In this guide, we'll walk you through every step of the process, ensuring you have all the information you need to get started.

Research and Planning

Market Research

Before diving into the home furnishings business, it's crucial to conduct comprehensive market research. Understand the current market trends, consumer preferences, and major competitors. Analyze the demand for various types of home furnishings, from contemporary to vintage styles.

Identifying Your Niche

Identifying a niche can set you apart from competitors. Whether it's sustainable furniture, luxury home accessories, or affordable décor, focusing on a specific segment helps target your audience more effectively.

Creating a Business Plan

A comprehensive business plan serves as your blueprint for achieving success. It should include your business goals, target market, competitive analysis, marketing strategy, and financial projections. A well-structured plan not only guides your business but also attracts potential investors.

Visa Options and Legal Requirements

Understanding Visa Requirements

As a foreigner, obtaining the proper visa is essential to legally live and work in the UK while running your Home Furnishings Business. Ensure you have the appropriate visa that grants you the right to do so.

Types of Visas Available

UK Innovator Founder Visa

This visa is for those looking to set up an innovative business. It requires an endorsement for the business idea, and there is no minimum investment level, but you must have sufficient funds to launch your venture.

Learn more about the Innovator Founder Visa.

UK Global Talent Visa

Aimed at leaders or potential leaders in digital technology, science, humanities, engineering, the arts, and more, this visa is ideal for highly skilled individuals who can contribute significantly to the UK.

Learn more about the Global Talent Visa.

UK Self-sponsorship Route

This route requires you to have a British national working for your business in the UK as an Authorising Officer before you can apply for a sponsor licence.

UK Expansion Worker Visa

Part of the Global Business Mobility scheme, this visa is for overseas businesses that want to establish a presence in the UK.

Understand the UK Expansion Worker Visa.

Self-employed Visa

For individuals planning to work for themselves in the UK, this visa is suitable for entrepreneurs who prefer to operate independently.

Our team of business expansion experts possesses in-depth knowledge of the UK immigration system, specifically for foreign entrepreneurs. They can guide you to choose the most suitable visa path to launch your Home Furnishings Business in the UK!

Business Structure Options

Decide on the legal structure of your business. You can decide to run your business as a sole trader, partnership, or limited company, each of which has unique benefits and legal considerations.

Registering Your Business

Register your business with Companies House if you're setting up a limited company. For sole traders and partnerships, registration is less complex but equally important.

Understanding UK Taxation

Familiarize yourself with the UK taxation system. You'll need to understand VAT, corporate tax, and other relevant taxes. Consider hiring a local accountant to ensure compliance and efficient tax management.

Financial Planning

Initial Investment and Funding Options

Determine the initial investment required for your business. Explore various funding options like personal savings, bank loans, and investors. You might also consider government grants available for small businesses.

Budgeting for Start-Up Costs

Create a detailed budget covering start-up costs such as premises, inventory, marketing, and legal fees. Accurate budgeting prevents financial pitfalls and ensures smooth operations.

Financial Forecasting

Develop financial forecasts to predict your business’s performance over the next few years. This includes projected income, expenses, and profit margins, helping you make informed financial decisions.

Location and Premises

Choosing the Right Location

Location plays a critical role in the success of a home furnishings business. Select a spot that attracts a lot of walkers and is easily reachable. Research the local market to understand the demand in different areas.

Leasing vs. Buying Premises

Decide whether to lease or buy your business premises. Leasing offers flexibility, while buying is a long-term investment. Consider your financial capacity and business goals before making a decision.

Setting Up a Showroom

A well-designed showroom attracts customers and enhances their shopping experience. Invest in interior design to create an inviting atmosphere that showcases your products effectively.

Sourcing and Inventory

Finding Reliable Suppliers

Building relationships with reliable suppliers is crucial. Attend trade shows, visit supplier factories, and negotiate terms to ensure quality and timely delivery of your products.

Importing Goods

If you plan to import goods, understand the customs regulations and import duties in the UK. This knowledge helps avoid legal issues and ensures smooth import operations.

Managing Inventory

Efficient inventory management prevents overstocking and stockouts. Implement inventory management software to keep track of your stock levels and streamline your supply chain.

Branding and Marketing

Creating a Strong Brand Identity

Your brand identity sets you apart from competitors. Create an original brand identity, including a distinctive brand name, logo, and tagline that connects with your desired customer base. Consistent branding builds recognition and trust.

Digital Marketing Strategies

Digital marketing plays a crucial role in expanding your reach to a wider audience. Utilize SEO, content marketing, email campaigns, and online advertisements to drive traffic to your website and store.

Utilizing Social Media

Social media platforms like Instagram, Facebook, and Pinterest are perfect for showcasing home furnishings. Engage with your audience through posts, stories, and live videos to build a loyal following.

Sales Strategies

Setting Up an Online Store

An online store broadens your customer base beyond the local market. Choose a user-friendly e-commerce platform and optimize your website for mobile users. Offer comprehensive product details alongside premium visuals.

In-Store Sales Techniques

Enhance in-store sales by training your staff in effective sales techniques. Personalized service and product demonstrations can significantly boost sales and customer satisfaction.

Building Customer Relationships

Building strong relationships with customers encourages repeat business. Implement a loyalty program, send personalized emails, and provide excellent after-sales service to keep customers coming back.

Compliance and Regulations

Health and Safety Regulations

Make sure your business adheres to health and safety standards. This includes fire safety, electrical safety, and proper storage of hazardous materials. Regular inspections help maintain a safe environment for customers and staff.

Consumer Rights and Protection

Understand consumer rights and protection laws in the UK. This includes clear return and refund policies, product warranties, and accurate product descriptions to avoid legal issues.

Environmental Regulations

Adhere to environmental regulations by managing waste responsibly and using sustainable materials. Promoting eco-friendly practices can also attract environmentally conscious customers.

Hiring and Training Staff

Recruitment Strategies

Recruit skilled staff to provide excellent customer service. Advertise job openings on job boards, social media, and local newspapers to attract potential candidates.

Training Programs

Implement comprehensive training programs to equip your staff with product knowledge and sales skills. Ongoing training ensures they stay updated with the latest trends and techniques.

Employee Benefits and Retention

Offer competitive salaries and benefits to retain talented staff. A positive work environment and opportunities for career growth also contribute to employee satisfaction and retention.

Technology and Infrastructure

Implementing Retail Management Software

Retail management software streamlines operations by integrating sales, inventory, and customer data. Select software that aligns with your business requirements and financial constraints.

E-commerce Platforms

Selecting the right e-commerce platform is crucial for online sales. Popular options include Shopify, WooCommerce, and Magento. Ensure the platform supports your business scale and provides necessary features.

Utilizing Data Analytics

Data analytics helps understand customer behavior and preferences. Use this information to make informed decisions about product offerings, marketing strategies, and inventory management.

Customer Service

Importance of Customer Service

Exceptional customer service differentiates your business from competitors. Train your staff to handle queries effectively and resolve issues promptly. Satisfied customers are inclined to come back and refer your business to others.

Handling Complaints and Returns

Develop a clear policy for handling complaints and returns. Addressing customer concerns promptly and professionally helps maintain your business’s reputation and builds customer loyalty.

Building a Loyal Customer Base

Create strategies to build a loyal customer base, such as loyalty programs, exclusive discounts, and personalized services. Engaging with customers and making them feel valued fosters long-term relationships.

Networking and Partnerships

Joining Industry Associations

Join industry associations to stay connected with the latest trends and network with other professionals. These associations often offer training, certifications, and industry news.

Building Supplier Relationships

Strong relationships with suppliers ensure consistent product quality and availability. Regular communication and fair negotiations build trust and long-term partnerships.

Partnering with Local Businesses

Partner with local businesses for cross-promotions and events. Collaborations can increase your visibility and attract new customers.

Adapting to Market Trends

Keeping Up with Design Trends

Keep up-to-date of the most recent design trends to align with customer preferences. Attend trade shows, read industry publications, and follow design blogs to stay ahead of the curve.

Sustainability in Home Furnishings

Sustainability is becoming increasingly important. Offer eco-friendly products and promote sustainable practices to attract environmentally conscious consumers.

Adapting to Consumer Preferences

Regularly seek customer feedback and adapt your offerings accordingly. Flexibility and responsiveness to consumer preferences help maintain relevance in the market.

Conclusion

Starting a home furnishings business in the UK as a foreigner involves careful planning, research, and dedication. By understanding the market, securing the right visa, and implementing effective business strategies, you can establish a successful venture.

Remember, persistence and adaptability are key to thriving in this competitive industry.

Contact The SmartMove2UK

Ready to Furnish Your Future in the UK?

Start your entrepreneurial journey with confidence by partnering with The SmartMove2UK. Our team of expert business immigration consultants is dedicated to guiding you through every step of starting your Home Furnishings Business in the UK. From selecting the right visa to crafting a solid business plan, we're here to ensure your venture is built on a strong foundation.

Don't let the complexities of immigration reduce your dream. Connect with The SmartMove2UK today, and let's weave success into your business tapestry!

Contact Us Now - Transform your vision into reality with The SmartMove2UK.

FAQs

What are the initial steps to start a home furnishings business in the UK?

The initial steps include conducting market research, creating a business plan, securing the appropriate visa, and registering your business with Companies House.

Do I need a visa to start a home furnishings business in the UK as a foreigner?

Yes, you need a visa to legally live and work in the UK. Options include the Innovator Founder Visa, Global Talent Visa, Self-sponsorship Visa, Expansion Worker Visa, and Self-employed Visa.

How can I find reliable suppliers for my home furnishings business?

Attend trade shows, visit supplier factories, and build relationships through regular communication and fair negotiations.

What are the key legal requirements for setting up a home furnishings business in the UK?

Key requirements include registering your business, understanding UK taxation, complying with health and safety regulations, and adhering to consumer rights and environmental laws.

How important is digital marketing for a home furnishings business?

Digital marketing is crucial for reaching a broader audience, driving traffic to your website, and building brand awareness through SEO, content marketing, and social media engagement.

0 notes

Text

VAT in Bromsgrove

Introduction

Value Added Tax (VAT) is a crucial aspect of financial compliance for businesses in Bromsgrove, including those under the JRMA (John, Richard, Michael, and Associates) umbrella. Understanding the nuances of VAT helps in maintaining proper financial records, ensuring compliance with HMRC regulations, and optimizing tax liabilities.

What is VAT?

VAT is a consumption tax levied on goods and services at each stage of production or distribution. In the UK, the standard VAT rate is 20%, with reduced rates for certain goods and services. Businesses with an annual turnover exceeding £85,000 must register for VAT and charge it on their products or services.

VAT Registration and Compliance

For JRMA in Bromsgrove, VAT registration involves applying to HMRC. Once registered, JRMA must issue VAT invoices, maintain accurate records, and submit periodic VAT in Kidderminster. The returns detail the VAT charged on sales (output tax) and the VAT paid on purchases (input tax). The difference between the two is the amount payable to or reclaimable from HMRC.

VAT Schemes and JRMA

Several VAT schemes can benefit JRMA depending on its business nature and turnover:

· Standard Accounting Scheme: Suitable for most businesses, it requires quarterly VAT returns.

· Flat Rate Scheme: Simplifies VAT reporting for small businesses by applying a fixed rate to gross turnover.

· Cash Accounting Scheme: Allows VAT to be accounted for only when payment is received or made, aiding cash flow management.

· Annual Accounting Scheme: Reduces the frequency of VAT returns to once a year, with advance payments made throughout the year.

· Benefits of Proper VAT Management

· Efficient VAT management can provide several benefits for JRMA, such as:

· Improved Cash Flow: Schemes like cash accounting can enhance cash flow by aligning VAT payments with actual receipts.

· Tax Savings: Accurate record-keeping ensures that all eligible input VAT is reclaimed, reducing overall tax liability.

· Compliance: Avoiding penalties and interest charges through timely and accurate VAT returns.

Conclusion

VAT is a vital component of financial management for JRMA VAT in Bromsgrove. By understanding the different VAT schemes and maintaining compliance with HMRC regulations, JRMA can optimize its tax liabilities, improve cash flow, and ensure smooth business operations. Proper VAT management is essential for the financial health and legal compliance of any business entity.

0 notes

Text

Benefits of Converting from a Sole Trader to a Limited Company

New Post has been published on https://www.fastaccountant.co.uk/sole-trader-to-a-limited-company/

Benefits of Converting from a Sole Trader to a Limited Company

Are you a sole trader looking to take your business to the next level? Converting from a sole trader to a limited company can bring you a host of benefits, from tax advantages to increased financial security. This process involves a few essential steps, such as registering a limited company and transferring business assets. To fully grasp the tax implications and ensure a smooth transition, it is wise to seek advice from a professional accountant. By becoming a limited company, you can enjoy the perks of limited liability, while distinguishing your business as a separate legal entity from yourself as a shareholder or director.

Steps of Conversion

Registering a Limited Company

The first step towards converting from a sole trader to a limited company is registering your new entity with Companies House. In the UK, you need to register your limited company with Companies House. This process involves providing key details such as the company name, registered address, and details of directors and shareholders. Companies House will issue a Certificate of Incorporation once the registration is complete, confirming your limited company’s legal existence.

Informing HMRC

Next, it is crucial to inform HM Revenue and Customs (HMRC) of the change in your business structure. You need to notify HMRC that you are ceasing self-employment as a sole trader and becoming a limited company. This allows HMRC to update their records and ensure you are subject to the correct tax rules and obligations moving forward.

Transferring Business Assets

As you convert from a sole trader to a limited company, you will need to transfer your business assets appropriately. This involves transferring real estate, vehicles, equipment, and any other business assets into the name of your limited company. It’s essential to consult with a qualified accountant or legal professional to ensure these transfers are done correctly and in compliance with tax and legal regulations.

Setting up a Business Bank Account

To fully separate your personal and business finances, you must establish a dedicated business bank account for your limited company. This bank account will be used to receive business income, pay expenses, and conduct all financial transactions related to your company. Opening a business bank account also provides a clearer picture of your business’s financial health and simplifies the process of tracking income and expenses for tax purposes.

Notifying Stakeholders

Lastly, it is crucial to notify your clients, suppliers, employees, and any other stakeholders about the conversion from a sole trader to a limited company. Ensuring open communication and transparency about the change in your business structure builds trust and maintains positive relationships. Let them know about the new company name, updated contact information, and reassure them that it’s business as usual.

youtube

Tax Implications of Sole Trader to a Limited Company

Understanding Tax Obligations

As a limited company, your tax obligations will differ from those as a sole trader. It is important to have a clear understanding of these new tax requirements to ensure compliance and avoid unnecessary penalties. Consulting with an experienced accountant is highly recommended to navigate the intricacies of corporation tax, VAT, PAYE, and other tax obligations specific to limited companies.

Optimizing Tax Planning

With the guidance of a knowledgeable accountant, you can strategically plan your taxes to minimize your tax liability. They can help you identify available tax allowances, deductions, and reliefs that apply to limited companies. By optimizing your tax planning, you can retain more of your earnings, reinvest in your business, or allocate funds to further grow your wealth.

Reducing Personal Tax Liability

Converting to a limited company opens up possibilities for reducing your personal tax liability. Through tactics like income splitting, as mentioned earlier, you can distribute income among shareholders, potentially lowering your overall personal tax burden. Additionally, limited company directors can structure their remuneration packages to take advantage of various tax-efficient options, such as salary, dividends, and pensions.

Limited Liability

Protection of Personal Assets

Perhaps one of the most significant advantages of a limited company structure is limited liability. As a sole trader, you are personally responsible for any debts or legal claims against your business. This means your personal assets, such as your house or savings, can be at risk. By converting to a limited company, your personal liability is limited to the value of your shareholding. In case of business-related financial difficulties, your personal assets are generally safeguarded.

Reduced Financial Risk

Operating as a limited company can help mitigate financial risks associated with running a business. Sole traders face a higher degree of personal financial exposure, as all business liabilities ultimately fall on their shoulders. Limited companies, on the other hand, distribute the risk among shareholders, limiting the financial impact on any one individual. This can provide a sense of security, allowing you to focus on growing your business without constant worry about personal financial repercussions.

Separate Legal Identity

Distinction Between Company and Owners

Converting to a limited company creates a clear separation between the company and its owners (shareholders). The limited company is considered a separate legal entity, distinct from the individuals who own and operate it. This separation ensures that the company’s actions and liabilities are separate from those of the shareholders, providing a level of protection in legal matters.

Legal Protection

As a sole trader, your personal assets are linked directly to your business. This means that any legal disputes, debt collection, or legal claims against your business could directly impact your personal finances. By operating as a limited company, you benefit from legal protection that shields your personal assets from such claims. This protection not only offers peace of mind but also allows you to approach business decisions with greater confidence.

Professional Advice

Consulting with an Accountant

During the process of converting from a sole trader to a limited company, seeking professional advice becomes essential. An experienced accountant can guide you through the entire conversion process, ensuring compliance with legal and tax regulations. They can also assist in analysing the financial implications and help you plan for the future to maximize your business’s growth potential.

Analysing Financial Implications of Sole Trader to a Limited Company

Converting from sole a trader to a limited company entails various financial implications that need to be carefully analysed. An accountant can assess the financial impact on your business and provide insights into potential tax savings, funding opportunities, and cash flow management. By thoroughly understanding the financial implications of the conversion, you can make informed decisions and set realistic financial goals for your limited company.

Ensuring Compliance with Regulations

Operating as a limited company involves adhering to various legal and regulatory requirements. An accountant’s role is to ensure that your limited company stays compliant with these obligations, including VAT registration, payroll compliance, and corporation tax filing. By relying on their expertise, you can minimize the risk of penalties, maintain a good standing with authorities, and focus on driving the success of your limited company.

Employment Opportunities

Enhanced Credibility for Job Applicants

When it comes to attracting top talent, operating as a limited company carries weight in the eyes of potential job applicants. Job seekers often perceive limited companies as more stable, professional, and economically secure. By making the transition, you demonstrate your commitment to business growth and provide a more secure work environment, increasing your chances of attracting high-caliber candidates who share your vision.

Ownership and Succession

Shares and Ownership Structure

As a limited company, you have the flexibility to structure ownership through share distribution. This enables you to allocate ownership percentages to shareholders based on various factors, such as their level of involvement, financial investment, or contribution to the business. By carefully designing the ownership structure, you can ensure fairness and transparency, as well as facilitate future ownership transitions or the sale of the company.

Facilitating Transfer or Sale of Company

Converting from sole a trader to a limited company makes it easier to transfer or sell the business in the future. As a separate legal entity, the limited company can be bought or sold, allowing for greater flexibility and potential exit strategies. Whether you plan to retire, pass on the business to family members, or attract investors for future expansion, the limited company structure provides a framework to facilitate these transactions smoothly.

Business Expansion

Access to External Investment

Limited companies have a broader range of options when it comes to securing external investment. From venture capital firms to angel investors, the perception of Limited companies as more serious and credible entities can attract additional funding sources. This influx of capital can fuel your business expansion plans, whether it be scaling operations, developing new products, or entering new markets. The limited company structure allows you to tap into these opportunities with greater ease.

Easier to Raise Capital

Raising capital is an essential aspect of business growth, and limited companies generally have an advantage in this area. As a limited company, you can issue shares or sell equity to investors, increasing funding options compared to being a sole trader. Investors are more likely to invest in a limited company due to the legal protections and increased transparency associated with such business structures. Having more options for raising capital can be a pivotal factor in accelerating your business’s growth trajectory.

In conclusion, converting from a sole trader to a limited company offers a multitude of advantages. From tax benefits, increased financial security, and limited liability protection to enhanced credibility, employment opportunities, and business expansion possibilities, the decision to make this transition can have long-lasting positive effects on your overall business success. However, it is essential to seek professional advice and carefully evaluate the financial and legal implications of such a move. With proper planning and guidance, converting to a limited company can become a strategic step towards realizing your business’s full potential.

0 notes

Text

Bureaucracy Blitz or Brews and Business? Setting Up Business in the UK

The United Kingdom has a long and storied history as a global center for commerce and entrepreneurship. But for aspiring business owners, navigating the process of setting up shop in the UK can feel like wading through a sea of paperwork. Fear not, intrepid entrepreneur! This guide will equip you with the knowledge to tackle the UK business setup process and understand the tax implications of your venture. Choosing Your Business Structure: Sole Trader, Limited Company, or Beyond? The first step involves selecting the most suitable business structure. For freelancers and those running small-scale operations, becoming a sole trader is the simplest option. There's no need to register a separate business entity, and you'll file your business income under your personal tax return. However, this structure comes with drawbacks; you'll have unlimited liability, meaning your personal assets are at risk if the business incurs debts. For those seeking a more formal structure with limited liability, a limited company is the way to go. This involves registering your business with Companies House, the official register for companies in the UK. Limited companies offer greater credibility and are often preferred by investors and business partners. However, they come with additional reporting and administrative requirements. Government Gateway: Your One-Stop Shop for Business Registration Thankfully, the UK government has streamlined the business registration process through the GOV.UK website. This online portal allows you to register your business as a sole trader or limited company, as well as obtain a Unique Taxpayer Reference (UTR) number for filing tax returns. The process is relatively straightforward, though consulting an accountant can be helpful, especially for navigating the nuances of limited company registration. Tax Time: Understanding Your Obligations Once your business is up and running, you'll need to grapple with the realities of UK taxation. The specific taxes you'll be liable for depend on your business structure. - Sole Traders: As a sole trader, you'll pay income tax on your business profits through your Self Assessment tax return. Additionally, you'll likely need to pay National Insurance contributions, which fund the UK's social security system. - Limited Companies: Limited companies pay corporation tax on their profits. The current rate for corporation tax in the UK is 19%, which is relatively competitive on a global scale. Limited company directors may also need to pay income tax on any dividends they receive from the company. Beyond Income Tax: VAT and Other Considerations Depending on the nature of your business and your annual turnover, you might also be required to register for Value Added Tax (VAT). VAT is a sales tax that applies to most goods and services sold in the UK. Registering for VAT adds an extra layer of complexity to your tax filings, so it's crucial to understand the thresholds and implications before registering. Seeking Help: When to Hire an Accountant While the UK business setup process has become more user-friendly, navigating the tax system can be complex. Don't be afraid to seek professional help from an accountant. A qualified accountant can advise you on the most suitable business structure, ensure you're complying with all tax regulations, and help you minimize your tax burden. Preparation is Key Setting up a business in the UK can be a rewarding experience, but it requires preparation and a good understanding of the legalities involved. Research the different business structures, familiarize yourself with the tax system, and don't hesitate to seek professional help if needed. With careful planning and a bit of elbow grease, you can turn your entrepreneurial dreams into a thriving reality in the land of Big Ben and afternoon tea. Read the full article

0 notes

Text

Navigating UK Tax: A Guide to VAT Returns

Tax season can be a daunting time for businesses, especially when it comes to understanding and managing Value Added Tax (VAT) returns in the UK. Whether you're a small business owner or a seasoned entrepreneur, staying on top of your tax obligations is crucial for financial health and compliance. In this guide, we'll delve into the intricacies of UK tax, focusing specifically on VAT returns and how you can navigate them with confidence.

Understanding VAT

VAT is a consumption tax levied on the value added to goods and services at each stage of production or distribution. In the UK, VAT applies to most goods and services provided by businesses, as well as some goods and services imported from outside the European Union.

There are different VAT rates applicable to various goods and services, including the standard rate of 20%, reduced rates of 5% and 0%, and exemptions for certain goods and services like food, children's clothing, and healthcare.

VAT Registration

Businesses with taxable turnover exceeding the VAT threshold must register for VAT with HM Revenue & Customs (HMRC). As of 2024, the VAT registration threshold is £85,000. However, businesses with turnover below this threshold can voluntarily register for VAT.

Once registered, businesses must charge VAT on their taxable sales (output tax) and can reclaim VAT on eligible purchases (input tax). VAT-registered businesses are required to submit VAT returns to HMRC, usually on a quarterly basis, detailing their VAT transactions.

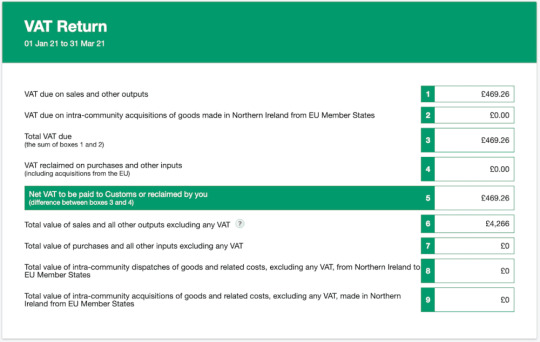

VAT Returns

A VAT return is a document submitted to HMRC summarizing the VAT due on sales and VAT reclaimable on purchases during a specific accounting period. Businesses must accurately report their VAT transactions in their VAT returns to ensure compliance with tax regulations.

When completing a VAT return, businesses must include the total value of sales and purchases subject to VAT, as well as any VAT owed to or reclaimable from HMRC. VAT returns can be filed online using HMRC's Making Tax Digital (MTD) system, which aims to streamline the tax reporting process and improve accuracy.

Tips for VAT Compliance

To ensure compliance with VAT regulations and minimize the risk of errors or penalties, businesses should:

Keep detailed records of all VAT transactions, including sales invoices, purchase receipts, and VAT accounting records.

Reconcile VAT transactions regularly to identify any discrepancies or missing documentation.

Familiarize themselves with VAT rules and regulations, including VAT rates, exemptions, and thresholds.

Seek professional advice from accountants or tax advisors to navigate complex VAT issues and ensure compliance with tax laws.

Utilize accounting software or online VAT filing services to automate VAT calculations and streamline the VAT return process.

By following these tips and staying informed about VAT regulations, businesses can effectively manage their VAT obligations and avoid costly mistakes.

Conclusion

Navigating UK tax, particularly VAT returns, requires careful attention to detail and a good understanding of tax regulations. By registering for VAT, maintaining accurate records, and submitting timely VAT returns, businesses can ensure compliance with tax laws and minimize the risk of penalties.

While VAT compliance may seem daunting, especially for small businesses, there are resources and tools available to simplify the process. Whether it's leveraging digital accounting software or seeking professional advice, businesses can take proactive steps to navigate UK tax with confidence.

Remember, VAT compliance is not just about meeting legal requirements—it's also about ensuring financial stability and fostering trust with customers and stakeholders. By prioritizing VAT compliance, businesses can lay the foundation for long-term success in the ever-changing landscape of UK taxation.

1 note

·

View note

Text

> 2021 EU VAT on e-Commerce (EU VOEC) Legislation

Your disbursements have been deactivated in all stores you operate worldwide (excluding Amazon.in) from ... as we have indicators that you might not be EU established for VAT purposes. As a result, we need you to provide additional documentary evidence proving that your company is established in the EU in accordance with this legislation, within 60 days of this notification.

Why did this happen?

From 1 July 2021, Amazon is liable to collect and remit VAT on B2C sales from non-EU established Selling Partners to B2C customers in EU under the EU VAT on e-Commerce legislation. We have taken this measure because as per investigation taken on your account, we found indicators that that your business is established outside the EU for VAT purposes. Hence, we need to get the documentary evidence to ensure we apply the correct treatment to your B2C sales.

I am established in the EU. How do I get my disbursements released?

If you believe you meet EU business establishment requirements, submit the required documents to the mail-id corresponding to your country of establishment provided on the ‘Determination of Establishment for EU VAT’ page: https://sellercentral.amazon.co.uk/.../voec-uk-establishment.

Note that you have to send the documents required using your Amazon Seller Central registered email id. It will take us up to 3 days to review the documents provided by you. At any point, if we conclude based on the provided documentary evidence that your company is established in the EU, we will release your disbursements within 24 hours of completing the verification. This will become available to you as per your normal payment cycle.

I do not meet EU establishment requirements. How can I get my disbursements released?

Send an email to [email protected] from your seller central registered mail id and inform us (i) that you are not established and (ii) the country from which you operate. There is no requirement to provide any documentation where this is confirmed as being non-EU.

In such a case, additionally, you will be required to pay the VAT amount to Amazon to account for the historical un-paid VAT on all B2C sales that fall under EU VAT on eCommerce legislation since 1 July 2021. We will inform you the next steps within one week after receiving your email.

Note: Do not send any documents to this id [email protected] if you are established in the EU. Documentary evidence to prove that you are established in the EU should only be sent as per the instructions in the section above.

What happens if I don’t take the required actions?

If you fail to provide the documentary evidence within 60 days of this notification, we will conclude that you are not established in EU and will start collecting and remitting VAT on your B2C sales. In such a case, additionally, you will be required to pay the VAT amount to Amazon to account for the historical un-paid VAT on all B2C sales that fall under EU VAT on eCommerce legislation since 1 July 2021. You may continue selling on Amazon, but you will not be able to disburse any funds from your accounts, until any EU VAT owed is paid...

Амазон спрашивает, где зарегистрирован ваш бизнес - в ЕС или нет. Если в стране ЕС, то надо предоставить подтверждающие документы. Если нет, то сообщить страну без предоставления каких-либо документов. Ваш ответ определит действия Амазон по европейскому VAT с ваших продаж.

> 2021 UK VAT on e-Commerce (UK VOEC) Legislation

See required documents

If you have registered, and operate, your Sell on Amazon account through an incorporated company or partnership (or similar) then you will be required to provide the following documentation to Amazon.

1. Evidence of VAT Registration (If registered)

Provide evidence of your VAT registration number ensuring that:

the registered name in HMRC VRN Checker is associated with your registered name on Amazon; and

the registered address in HMRC VRN Checker is associated with your registered address on Amazon.

If this information is not aligned, it may not be accepted by Amazon. Work with your Tax Advisor to ensure this is updated correctly with the relevant tax authority. If you are not required to be VAT registered in your country of establishment because your sales activity is below the registration threshold, provide these details in your response. If you are exempt from VAT registration, or not required to register for any other reason, provide these details and supporting evidence (e.g. a letter of exemption issued by the Tax Authorities) in your response

2. Evidence of physical operations at your stated UK business address

You must provide two documents, one from each category:

Category A

A recent UK council tax bill or business rates of the current year addressed to the company or a director/Partner of the company; or

A recent utility bill issued less than 180 days ago addressed to the company or a director/Partner of the company or; or

If you are using a shared working space, either your licence agreement, or copies of invoices for payment of rent, in the your name with the shared working space provider for a period of 6 months or longer.

Category B

A recent copy of an invoice addressed to the company as its primary place of business for goods or services that it has used to operate its business.

If the documents are issued in the name of the director/Partner, such director/Partner should be listed in UK Company House.

Documents for locations that are virtual offices or mail forwarding locations do not qualify as proof that you have UK primary place of business address. You will need to provide proof of a physical address.

3. Evidence of registration of your legal entity/partnership at the UK Company House

Provide an extract from your trade registry from UK Companies House which includes the following information:

Registered legal name;

Registered address; and

A list of all registered Directors of this legal entity.

If this information is not aligned with your Sell on Amazon account then it may not be accepted by Amazon. Work with your Tax Advisor to ensure this is updated correctly with the relevant authority or in Seller Central.

4. Proof of Identity and UK residence of the Directors / Partners (or similar)

Provide the following documentation to evidence the identity and UK residence of your directors/partners per the trade registry:

Proof of Identity

Full valid passport; or

Full valid driving licence.

Proof of Residence in the UK

Full UK photo card driving licence bearing residential address (if not already used as your proof of identity); or

UK council tax bill for the current year; or

Bill from utility company in the name of the director/partner, which is not older than 180 days; or

UK mortgage statement; or

TV licence letter or Direct Debit schedule. This should confirm the name, address and existence of TV licence; or

Electoral roll search in the name of the director/partner; or

Phone bill – landline only in the name of the director/partner, which is not older than 180 days.

If any of your directors does not reside in the UK, provide a written confirmation of this in your email. There is no requirement to provide documentary evidence.

5. Proof of Permanent Employment and UK Bank Account

If 50% or more of your Directors are non-UK residents then provide two documents, one from each category:

Category A

HMRC correspondence demonstrating the Selling Partner has registered with HMRC for PAYE, less than 180 days old; or

PAYE demand from HMRC or a screenshot of the PAYE return submission less than 180 days old, accompanied by pay slip less than 180 days old or P60 valid for the current year for the employee.

Category B

A statement from local bank account in the name of the company/partner/director, dated less than 90 days old.

0 notes

Text

Establishing Your Business in the UK: A Comprehensive Guide to Company Registration

The United Kingdom, with its bustling economy and favorable business environment, serves as an attractive destination for entrepreneurs and investors worldwide. The process of registering a company in the UK is relatively straightforward and streamlined, allowing you to quickly establish your presence in this dynamic market.

Company Registration: The Essentials

Company registration in the UK involves several crucial steps that ensure your business complies with the legal and regulatory requirements. Here's a comprehensive overview of the registration process:

1. Choose a Company Structure:

The first step is to determine the most suitable company structure for your business needs. The two most common options are:

Sole Proprietorship: This is the simplest structure, where the business owner is personally liable for all debts and obligations.

Limited Liability Company (LLC): This structure offers limited liability protection, shielding the owners' personal assets from business debts.

2. Select a Company Name:

Your company name must be unique and comply with the UK's naming regulations. Avoid using offensive or misleading terms, and ensure the name accurately reflects your business activities.

3. Appoint a Company Director:

Every company must have at least one director, who is responsible for managing the company's affairs and ensuring compliance with legal requirements.

4. Register with Companies House:

Companies House is the official registrar of companies in the UK. To register your company, you'll need to submit the following documents electronically or by post:

Completed IN01 registration form

Memorandum of Association: This outlines the company's fundamental purpose and powers.

Articles of Association: These define the company's internal regulations and how it operates.

5. Obtain a Business Bank Account:

Opening a business bank account is essential for managing your company's finances. You'll need to provide proof of company registration and identification documents to open an account.

6. Apply for Necessary Business Licenses and Permits:

Depending on your industry and business activities, you may need to obtain specific licenses or permits from relevant authorities.

7. Comply with Tax and Regulatory Requirements:

As a registered company, you are subject to UK tax regulations. Register for Corporation Tax and Value Added Tax (VAT) if applicable. Stay updated on tax filing deadlines and compliance requirements.

Additional Considerations:

Registered Office Address: Every company must have a registered office address in the UK, which is the company's official address for legal and communication purposes.

Company Secretary: While not mandatory for small companies, appointing a company secretary can provide valuable administrative and governance support.

Share Capital: Determine the authorized share capital for your company, which represents the maximum amount of money you can raise through issuing shares.

Benefits of Company Registration in the UK:

Limited Liability Protection: LLCs offer limited liability protection, shielding owners' personal assets from business debts.

Tax Advantages: The UK offers a competitive corporate tax rate and various tax incentives for businesses.

Credibility and Recognition: A registered company gains credibility and recognition in the market, enhancing its ability to attract investors and customers.

Legal Framework: The UK provides a robust legal framework that protects business interests and promotes fair competition.

Seek Professional Guidance:

While the company registration process is relatively straightforward, it's always advisable to seek guidance from a qualified accountant or solicitor to ensure compliance with all legal and regulatory requirements. They can assist in preparing the necessary documentation, advising on tax implications, and ensuring your company is established on a solid foundation.

Conclusion:

Registering a company in the UK opens doors to a world of opportunities in a thriving business environment. By following the outlined steps and seeking professional guidance, you can seamlessly establish your business presence in the UK and embark on a successful entrepreneurial journey.

0 notes

Text

UK Sponsor Licence for Employers: Empower Your Organisation Now!

Table Of Contents:

What is a sponsor licence?

Eligibility requirements for UK sponsor licence

Required documents for UK sponsor licence application

UK Sponsor licence application fees

Applying for UK Sponsor licence

Benefits of holding a UK sponsor licence

What is a sponsor licence?

A sponsor licence, previously known as a Tier 2 sponsor licence, enables UK-based companies to employ skilled workers, to hire overseas employees or to enable a foreign national in the UK to switch into the Skilled Worker visa from various other visa types, including Tier 4 Student and Youth Mobility Scheme. Once approved, the licence is valid for four years and can be renewed.

Eligibility requirements for UK sponsor licence

To apply for a sponsor licence, your organisation must have a UK presence and operate lawfully in the country. If you have multiple UK branches, you may choose to apply for a single licence to cover all connected UK entities, or opt for separate licences based on your circumstances. Proof of registration with the appropriate body, as well as planning permission, may be required. The Home Office must be satisfied that you can provide genuine employment in a skilled occupation and pay the correct salary rate.

Required documents for UK sponsor licence application

Your Skilled Worker licence application typically involves submitting at least four specified mandatory documents, depending on your organisation's type, such as public bodies, startups, franchises, or SMEs.

Required documents may include-

Business bank statement

Employer's liability insurance

VAT registration certificate

Proof of HMRC employer registration, and

evidence of business premises ownership or lease.

Regulatory body registration evidence may also be necessary, especially for specific industries.

UK Sponsor licence application fees

The sponsor licence application fee varies according to your organisation's size and type. This fee is payable every four years when you renew your licence.

The Home Office reviews fees annually, and any changes are published. "Medium" and "large" organisations typically pay a fee of £1,476.

However, "small" organisations, including registered charities, pay a reduced fee of £536. Adding a subcategory to an existing 'Skilled Worker' sponsor licence incurs no extra fees.

Applying for UK sponsor licence

To apply for a sponsor licence, your company must complete an online application form, accompanied by at least four specified supporting documents demonstrating your UK trading presence.

Occasionally, the Home Office may request additional documents, such as evidence of your HR processes and compliance. Compliance visits may be conducted in person or online, considering COVID-19 restrictions.

Our team can conduct a mock HR audit to identify and rectify weaknesses before your formal application.

Know More: What is the Sponsor Licence Audit Process?

The advantages of having a UK sponsor licence

Once your organisation obtains a sponsor licence, it is registered with the Home Office and can issue Certificates of Sponsorship (CoS) to skilled foreign migrants. This is vital for many companies to access overseas skilled talent, particularly in a post-Brexit landscape with the end of freedom of movement. Companies must secure sponsorship for a significant portion of their workforce, underscoring the importance of holding a UK sponsor licence.

Read the Complete Guide here on UK Sponsor Licence

At Conroy Baker, we have extensive experience of helping companies acquire and maintain their Skilled Worker sponsor licences.

0 notes

Text

VAT Ai: What is an EORI Number?

Whether you're an established online seller or just starting out, understanding the EORI system is essential. In this blog post, we'll answer the most common questions about the EORI number and clarify its importance in global commerce.

What is an EORI Number?

EORI stands for Economic Operator Registration and Identification. It is a unique identification number assigned to businesses and individuals engaged in customs activities within the EU and the UK. The EORI number serves as a crucial identifier in customs declarations, facilitating smooth trade operations and ensuring proper compliance with customs regulations.

Who Needs an EORI Number?

If you are involved in importing or exporting goods to or from the EU, you’ll likely need an EORI number. This applies to a wide range of commercial operators, including online sellers who are part of the international supply chain.

How to apply for an EORI number?

Obtaining an EORI number is a straightforward process that involves submitting an application to your national customs authority. You'll need to provide details about your business and may need to submit additional documentation. The process is typically free of charge and can be completed online in most EU countries.

How long does it take to get an EORI number?

The time it takes to receive your EORI number can vary by country but usually is completed within a few days. It's advisable to apply well in advance of when you'll need it to avoid any disruptions in your shipping process.

What happens if I don’t have an EORI number?

Operating without an EORI number when one is required can lead to significant delays in customs and potential fines. It’s a crucial part of your business's legal obligations when trading internationally.

Do I need a separate EORI number for each EU country I trade with?

A common question is whether multiple EORI numbers are needed for trading in different EU countries. Typically, a single EORI number is sufficient as it is recognized across the EU.

Can I use my VAT number as an EORI number?

There is sometimes confusion about the distinction between VAT and EORI numbers. While they are related, an EORI number is specifically for customs identification, and businesses require both for international trade.

Impact of Brexit on EORI Numbers

Brexit has introduced changes to the way UK and EU businesses trade with each other. Depending on your location and trade arrangements, you may need a new EORI number to comply with post-Brexit regulations.

Introducing VAT Ai EORI Number Verification Tool

To simplify the EORI number verification process and enhance your trading experience, we offer an user-friendly EORI number verification tool: https://www.vatai.com/resources/eori You can quickly and easily verify the validity and correctness of EORI numbers for EU and UK entities, including your trading partners, suppliers, and customers.

The EORI number might seem like just another bureaucratic requirement, but it's a fundamental aspect of your international business that ensures a smoother customs process. Understanding and obtaining your EORI number is not just about compliance; it's about keeping your business moving in the global market. If you have further questions or need assistance, contact our experts today!

0 notes

Text

Making Tax Digital: Compliance Advice From Our Cloud-Based Accountants

Making Tax Digital, or MTD, has been on the agenda for some time now. Following delays and changes to the staggered introduction, most UK businesses now need to comply with MTD requirements for VAT submissions, ensuring they have compatible cloud computing software.

However, there is a larger group of companies that are not at the VAT registration threshold and should be conscious of when the plans to digitise the tax system are likely to affect their affairs, with scheduled transitions for Corporation Tax and Income Tax Self-Assessment (ITSA) on the horizon.

Let’s look at how organisations can adapt to pre-empt compliance requirements and become familiar with the complexities of MTD in good time before the next transitional phase begins to impact their reporting requirements and a cloud accounting system becomes mandatory.

A Recap of the Changes Introduced By Making Tax Digital

The basics of MTD are that the government and HMRC will require submissions and declarations to be made digitally using compliant cloud-based software packages that allow users to submit financial information directly through the tax office portal.

For most businesses, traditional accounting software will be incompatible, necessitating advice and guidance from an experienced commercial accountancy team to select viable, future-proof and efficient upgraded cloud-based accounting software systems that are MTD-ready.

As it stands, the current changes and anticipated phases include:

April 2022 – MTD for VAT returns applies to all VAT-registered UK companies.

April 2026 – MTD will apply to Income Tax Self-Assessment (ITSA) returns for self-employed taxpayers or small business landlords with an income of £50,000 or above.

April 2026 – MTD will roll out to Corporation Tax returns, although this could potentially be postponed further. There may be a staged introduction for small business owners, although this is not yet confirmed.

April 2027 – MTD is expected to be introduced for ITSA sole traders and taxpayers with self-employment or property incomes above £30,000.

We do not yet have clarification about when MTD will apply to general partnerships or whether any of these expected introduction dates will change again. However, it remains essential for taxpayers across the scope of UK taxation to understand what these reforms will mean for them.

Services and Support Offered By Cloud Accounting Providers

The primary objective of MTD is to consolidate and simplify financial information reporting mechanisms. Rather than having the choice of paper-based filing, online submissions or software-based returns, the goal is for every business, VAT payer and taxpayer to use a unified system to declare their taxable activities through cloud accounting software.

Stalled implementations aside, there is no doubt that cloud-based accounting is a step-change in financial reporting, and there is no potential for any business to disregard MTD or assume it will not affect them sooner or later.

As a cloud-based accounting specialist, James Todd & Co can help at every stage, from offering independent recommendations about the cloud accounting software best suited to your business activities and sector to supporting transitions from outdated systems to new solutions with cloud-based accounting functionality.

Cloud accounting offers many advantages above and beyond MTD. Financial data and records are stored through secure servers in the cloud, accessible via an internet connection rather than on a desktop-based hard drive or static server.

Businesses switching to cloud-based software can use real-time reporting, generate sales orders remotely, have secure access to their accounting software on any device, and permit multiple users to access reports concurrently to save time.

Advanced cloud accounting software replaces the manual aspects of double-entry bookkeeping and can handle data entry, cash flow forecasts and multiple currencies with live bank feeds updated automatically, alongside other functions to handle payroll and small business forecasts.

How to Prepare for MTD Compliance

The first task we’d recommend for any company looking to prepare for MTD is to audit and assess all of the business processes and accounting software in use by the organisation. Having a detailed and comprehensive log is a useful starting point since you can determine how and where your data is currently stored and how you extract that data for VAT return and tax reporting purposes.

From there, it is important not only to select cloud accounting software that is fit for your business and sector but to look at the other benefits. Some software packages are ideally suited to specific industries, for example, or for remote-based or hybrid workforces.

There are several popular options for small business accounting software. As a Xero Gold Champion Partner and Sage Accounting Certified Expert, we can offer ample support comparing either of these solutions.

It may also be necessary to assess the in-house reporting processes you follow and think about whether your bookkeeping and financial staff have a sufficient understanding of MTD legislation and accounting needs to manage the transition. Many clients work with our team to receive independent guidance throughout as part of a tiered change management approach.

Having a well-laid-out plan helps companies and small business owners to see which records they currently store manually through paper-based bookkeeping or spreadsheets and use that information to pick software solutions that are streamlined, efficient, and appropriate.

Registering for MTD at the Applicable Time

As our summary above shows, not all businesses, nor all taxes, are immediately subject to MTD reforms. It is possible that additional postponements will impact the indicative dates when the tax office currently expects to introduce the next tranches of MTD enrolment.

However, knowing when and how this may influence your business and being poised to respond and register is a significant advantage, not least for your peace of mind.

In most cases, you will be notified by HMRC when it expects you to transition from an existing VAT, ITSA or Corporation Tax basis over to the new MTD system. You can also check in with our team of accomplished chartered accountants at any time whether you are unsure when MTD will apply to you, would like a consultation to discuss the appropriate software solutions, or have any questions about MTD now and into the future.

Source URL : - https://www.jamestoddandco.co.uk/tax-digital-cloud-based-accountants/

1 note

·

View note

Text

UK Tax Essentials for New Restaurant Owners

Navigating the UK tax system can be a hard task for new restaurant owners. Understanding your tax obligations is crucial for compliance and financial health.

This guide provides an overview of key tax considerations and steps to ensure your restaurant meets its tax responsibilities.

1. Overview of UK Tax System

Types of Taxes

The UK tax system comprises several types of taxes that businesses must be aware of, including income tax, corporation tax, VAT (Value Added Tax), business rates, and National Insurance contributions. Each tax has specific rules and rates that apply to different aspects of your business.

HM Revenue and Customs (HMRC)

HMRC is the government body responsible for tax collection and enforcement. It provides resources and guidance to help businesses understand and comply with their tax obligations.

Are you considering opening a restaurant in the UK as a foreigner?

Check out our comprehensive guide on "How to Open a Restaurant in the UK as a Foreigner" for all the information you need.

2. Registering Your Business

Business Structure

The tax obligations of your restaurant depend on its legal structure. Common structures include sole trader, partnership, and limited company. Each structure has different tax implications and administrative requirements.

Registering with HMRC

Once you have chosen your business structure, you must register with HMRC. This registration includes setting up for self-assessment, VAT, and PAYE (Pay As You Earn) if you have employees.

3. Corporation Tax

Who Pays Corporation Tax?

If your restaurant operates as a limited company, it must pay corporation tax on its profits. The current corporation tax rate is 19%, but rates can change, so it's essential to stay updated with HMRC announcements.

Filing and Payment

Corporation tax is due nine months and one day after the end of your accounting period. You must file a corporation tax return (CT600) with HMRC within 12 months of the end of your accounting period.

4. Value Added Tax (VAT)

VAT Registration

VAT is a tax on the sale of goods and services. If your restaurant’s taxable turnover exceeds £85,000 in a 12-month period, you must register for VAT. You can also register voluntarily if your turnover is below this threshold.

VAT Rates

The standard VAT rate is 20%. However, certain goods and services, such as children’s car seats and some energy-saving products, are subject to a reduced rate of 5%, and some items, such as food and children’s clothing, are zero-rated.

VAT Returns and Payments

VAT-registered businesses must submit VAT returns to HMRC, usually every three months. The return reports the amount of VAT you have charged on sales and the amount of VAT you have paid on purchases. Any difference must be paid to HMRC.

5. Business Rates

What Are Business Rates?

Business rates are a tax on properties used for business purposes. The amount you pay is based on the property’s rateable value, which is determined by the Valuation Office Agency (VOA).

Small Business Rate Relief

You may be eligible for small business rate relief if your property’s rateable value is below a certain threshold. This relief can significantly reduce your business rates bill.

6. National Insurance Contributions (NICs)

Employer NICs

If you employ staff, you must pay employer NICs on their earnings above a certain threshold. The current rate for employer NICs is 13.8%.

Employee NICs

Employees also pay NICs, which you must deduct from their wages and pay to HMRC on their behalf. The rates vary depending on the employee’s earnings.

7. Income Tax for Sole Traders and Partnerships

Self-Assessment

Sole traders and partners in a partnership must pay income tax on their business profits. You must file a self-assessment tax return each year, detailing your income and expenses.

Income Tax Rates